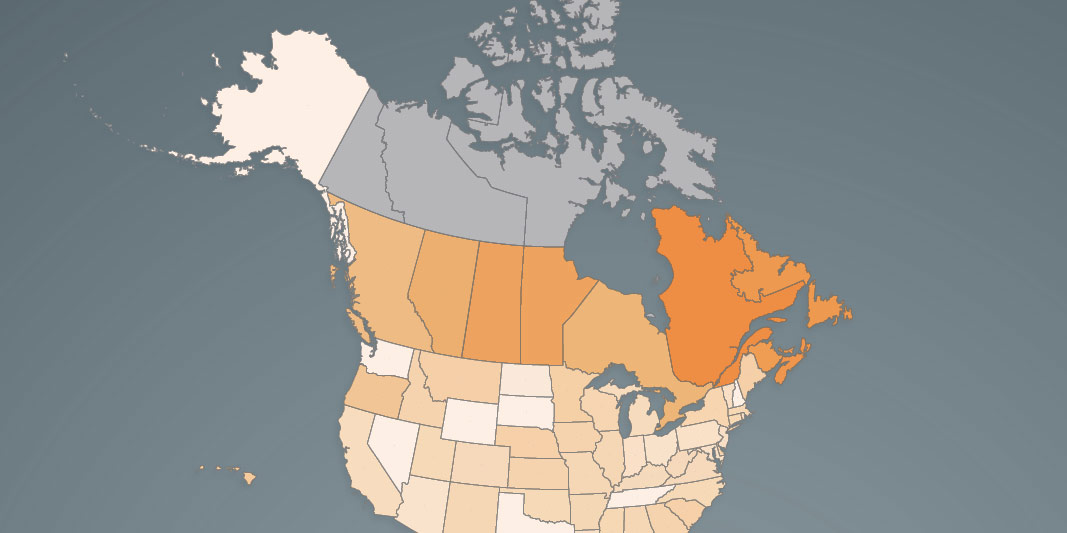

Workers in every province, across most of the income spectrum, faced higher income tax rates than workers in nearly every U.S. state.

personal income tax rate

The government spends billions of dollars each year on favoured businesses and industries.

The province has the fourth-highest top combined personal income tax rate among all provinces and U.S. states.

This year the top 20 per cent of income-earning families in Canada will pay 54.2 per cent of total taxes.

The tax increase will deter business investment in the economy and chase away capital.

An individual making C$50,000 per year faces a higher income tax rate in Ontario than in every U.S. state.

According to polling data, 80 per cent of Canadians don’t want average families to pay more than 40 per cent of their income in taxes.

The bottom 20 per cent of income-earning families pay 0.7 per cent of all federal and provincial personal income taxes.