The Impact of Proposed NDP-Green Tax Changes on British Columbian Families

— Published on June 14, 2017

Main conclusions

- An NDP-Green government in British Columbia would result in a marked shift in tax policy in the province. The new government would impose several significant tax increases including a rise in personal income taxes, carbon taxes, and business taxes. These increases would add a further $1.4 billion to the tax burden of British Columbians, assuming that the carbon tax increase was fully implemented.

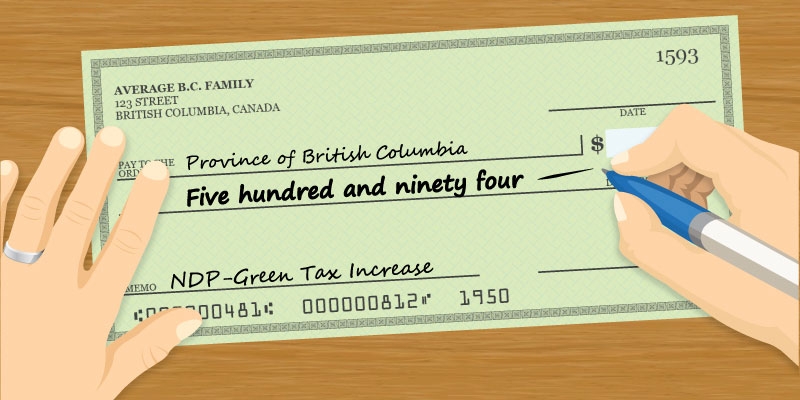

- Under the proposed NDP-Green tax changes, the average family’s tax bill would increase by $594, including a $482 increase in fuel and carbon taxes.

- BC families across the income spectrum can expect to pay more in taxes. Specifically, the increase in total taxes ranges from $144 for an average family in the $20,000 to $50,000 income group to over $1,000 for an average family in the $150,000 to $250,000 income group. The NDP-Green proposed Climate Action Rebate will likely protect those in the lower income group from some or all of the tax increase though details of the rebate are unknown as of this writing.

- Given the spending initiatives outlined in the NDP-Green Agreement and the billions of dollars of un-costed promises in the NDP election platform, an NDP-Green government would almost certainly institute tax increases beyond those listed above and/or run annual budget deficits (i.e., deferred taxation), neither of which are included in this analysis.

Authors:

More from this study

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.