Ford government faces three-pronged threat to Ontario’s competitiveness

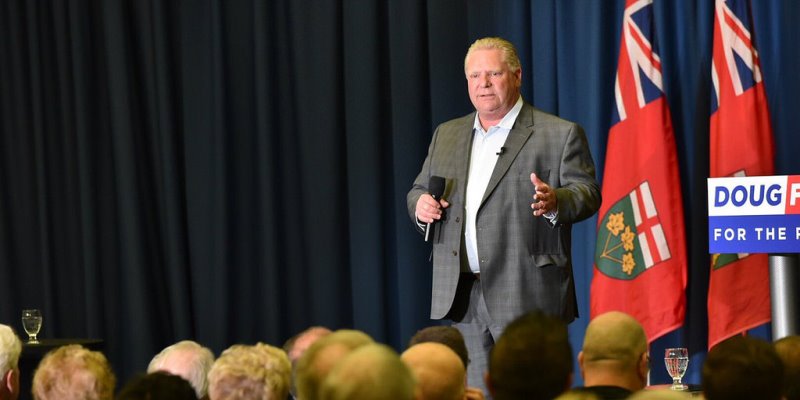

On the campaign trail, Doug Ford promised that, if elected, he’d bring business investment back to Ontario. This is exactly what the new government should focus on—but it’s easier said than done.

Ontario must constantly compete with other jurisdictions for investment. Our ability to compete, however, has been badly undermined in recent years, not only by provincial economic policies that made the province less attractive, but by harmful federal policy decisions. Meanwhile, our biggest competitor (the United States) has gone in the opposite direction with tax cuts and successful deregulation initiatives.

Taken together, harmful provincial policies, harmful federal policies and new competitive pressure from south of the border represent a three-pronged threat to Ontario’s competitiveness.

Let’s look at each prong in turn. The economic policy missteps of the Ford government’s predecessors are well-documented. For instance, the Wynne government cranked up business taxes and personal taxes on skilled professionals early this decade. Both increases were sold as temporary responses to fiscal challenges in the wake of the 2008-09 recession, but nearly a decade out from the recession’s end these tax hikes are still with us. Further, the McGuinty and Wynne governments piled more and more regulations onto the economy, driving up electricity prices and undermining Ontario’s competitiveness.

These developments would have been bad enough, but federal tax policy in recent years has made matters worse. Specifically, in 2015 the Trudeau government created a new top tax bracket, raising the marginal tax rates for many skilled professionals four more percentage points. Combined with provincial increases, this pushed the top marginal personal tax rate in Ontario to 53.53 per cent. From a competitiveness perspective, it’s easy to see how such a high tax rate could encourage some skilled professionals to choose to work in other jurisdictions where they can keep a larger share of what they earn.

Meanwhile, as provincial and federal public policy undermines Ontario’s economy, public policy in the U.S. has largely moved in the opposite direction. This is the third component of the three-pronged threat. In recent years, the U.S. has implemented substantial personal and corporate federal income tax cuts, which enhanced America’s attractiveness as an investment destination. Meanwhile, several competing states including Michigan, Indiana and Wisconsin launched ambitious state-level deregulation initiatives that make it easier for firms to prosper, grow and create jobs.

None of this is to say the U.S. doesn’t have problems. Indeed, its treasury is highly indebted and there are worrying signs of tear in the social and political fabric. But clearly, despite the problems, successful steps have been taken to attract more business investment and contribute at least somewhat to the robust growth the U.S. is enjoying.

Of course, the Ford government has little influence over developments in Ottawa, Washington or any U.S. state. But that makes it all the more important to get provincial policy right. In light of the three-pronged nature of Ontario’s competitiveness challenge, the provincial government must do much more than simply undo the policy mistakes of its predecessors—it must go further to bolster competitiveness, offset the harm from federal choices, and respond to competitive pressures south of the border.