Misunderstandings about capital gains taxes

Late last year we released a study showing how a province, specifically Alberta, could eliminate the provincial portion of the capital gains tax to lower the overall capital gains tax rate an entrepreneur, business owner or investor faces. The paper outlined the many benefits of a lower capital gains tax.

Two common criticisms of that study are worth responding to and clarifying. Both criticisms are rooted in the belief that a change in the capital gains tax overwhelmingly benefits high-income Canadians.

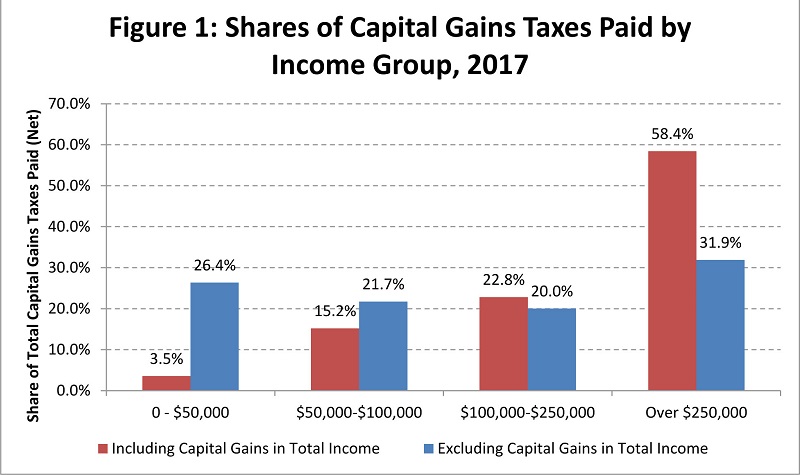

If one simply examines the incidence of capital gains taxes by income group (see table above), it’s easy to believe that reducing the capital gains tax would disproportionately benefit high-income Canadians. There are two problems with the data presented in in the table that lead to this conclusion—it shows that 58.4 per cent of capital gains taxes (net) were paid by those earning more than $250,000 in 2017. Thus the concern that a reduction in capital gains taxes would disproportionately benefit the top earners in Canada seems reasonable at first glance.

One of the better, more thorough examinations of capital gains taxes was completed by Prof. Herbert Grubel. His 2000 book, Unlocking Canadian Capital: The Case for Capital Gains Tax Reform, tackled this issue (along with many others) by examining the incidence of capital gains taxes by income group when the underlying capital gain is included in income versus when it’s excluded. Remember that half of a person’s capital gains are included in their taxable income.

The data presented in the table above updates and confirms Prof. Grubel’s original 2000 analysis. His insight in 2000 was that including one-time capital gains income in a person’s total income were skewing the results of which income groups and thus which Canadians were actually incurring capital gains taxes by boosting their taxable income. Consider a business owner who after many years of owning and running a business and sells it. Alternatively, consider a person who gains inheritance. These examples of one-time income are included in the underlying income determining that 58.4 per cent of capital gains taxes paid by those earning more than $250,000 per year or perhaps even more striking that 81.3 per cent of capital gains taxes in 2017 were paid by those earning more than $100,000.

The results are distinctly different when capital gains are removed from income. The chart below shows the distribution of capital gains taxes by four different income groups when capital gains are included and excluded from income. Such a change in the definition of income means that the share of capital gains taxes paid by those earning more than $250,000 falls from 58.4 per cent to 31.9 per cent.

Interestingly and quite telling about who actually pays capital gains taxes, the share of capital gains taxes paid by those earning less than $50,000 in 2017 and those earning between $50,000 and $100,000 increased from 3.5 per cent to 26.4 per cent, and from 15.2 per cent to 21.7 per cent.

Put simply, adjusting the underlying income for one-time capital gains is critical to get a more accurate, clearer picture of who actually pays capital gains taxes in Canada. When capital gains income is removed from total income, almost half (48.1 per cent) of all capital gains taxes in 2017 were paid by Canadians earning less than $100,000. Indeed, the results in the chart actually underestimate the degree to which average Canadians experience capital gains.

The second error made in interpreting the data from the table (near top) relates to the effect of registered retirement savings plans (RRSPs), registered pension plans (RPPs), sale of homes (principal residences) and tax-free savings plans (TFSAs). For many Canadians, these savings vehicles along with the equity in their house constitute the bulk, or even totality of their savings.

Capital gains incurred in these accounts are exempt from taxation and thus do not appear in a person’s annual income or in the capital gains tax statistics. In addition, the sale of a principal residence is also exempt from capital gains taxation. In other words, only capital gains that are incurred outside of these accounts and excluding one’s home appear in the tax statistics. Thus for most Canadians, the capital gains they earn do not show up in either their income statistics or the capital gains statistics.

Put simply, the worry about reducing or even eliminating capital gains and its effect on the distribution of taxes in Canada is over-stated once we better and more accurately understand who actually incurs and pays capital gains taxes.

Authors:

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.