Looming $1.7 billion operating deficit colours Ontario’s fiscal outlook

The spring 2016 Economic and Fiscal Outlook report of Ontario’s Financial Accountability Office (FAO) received notable attention given its projection that as a result of transit infrastructure spending, Ontario’s net debt would increase by approximately $54 billion to reach $350 billion by 2020-21. What received somewhat less attention were the more detailed expenditure and revenue projections made by the FAO and what they tell us about the Ontario government’s finances.

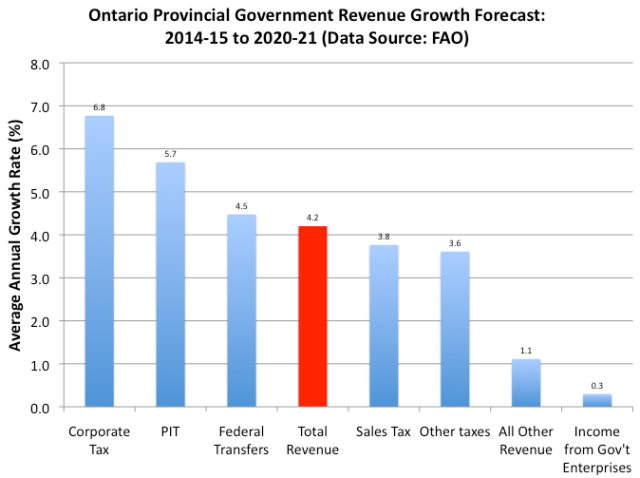

The FAO summary fiscal outlook forecasts total provincial government spending to rise from $128.9 billion to $150.3 billion between 2014-15 and 2020-21. This works out to total growth of 16.6 per cent for an average annual growth rate of 2.8 per cent annually. Meanwhile, total revenues are forecast to grow from $118.5 billion to $148.6 billion—total growth of 25.4 per cent representing an average annual growth rate of 4.2 per cent. Ontario seems to be hoping to solve its fiscal problems by relying on revenue growing faster than spending.

On the expenditure side, the fastest growing item will be interest on the debt, which is forecast to rise from $10.6 to $13.8 billion—for an annual average growth rate of five per cent. The slowest growing items at 1.3 and 1.9 per cent annually are post-secondary education and justice. The single largest expenditure item is health and it is expected to grow from $50 billion to $57.8 billion at 2.6 per cent annually—just a bit below the growth rate for total expenditure. As a result, health’s share of total expenditure is expected to fall slightly from 39 to 38 per cent, which may or may not materialize given the upward pressure on health spending from an aging population.

Also interesting is the revenue side. Corporate tax revenue is expected to rise from $9.6 billion in 2014-15 to $13.5 billion by 2020-21. Personal income taxes over the same period are expected to grow from $29.3 billion to $39.3 billion. Here we have income tax revenue forecast to grow quite briskly with corporate tax revenue growing at 6.8 per cent annually and personal income taxes (PIT) at 5.7 per cent. This is probably somewhat optimistic given that over the period between 2000 to 2014, personal income tax revenue grew at an annual average of about 4 per cent while corporate tax revenue was essentially flat. On the low side is income from government business enterprises, which will only grow at about one-third of one per cent.

The good news in all of this is that with total provincial government spending growing slower than GDP, the size of the public sector (measured as government spending as a share of GDP) is going to shrink. On the other hand, revenues are forecast to grow faster than nominal GDP with income tax revenues growing substantially faster than GDP.

What is truly unfortunate is the heavy reliance on forecasts of rising personal and corporate income tax revenues, which have serious economic incentive effects, to narrow the gap between revenues and expenditures. Moreover, despite revenues growing much faster than expenditures, by 2020-21, the Ontario government is sadly still anticipated to have an operating deficit of $1.7 billion.

Author:

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.