Global corporate tax cartel would be good for politicians, bad for workers

The Biden administration has proposed a $2 trillion spending plan, supposedly for infrastructure (though only a fraction of the money would be spent on roads and bridges), which will be partially financed by a significant increase in business taxes—including an increase in the federal government’s corporate tax rate from 21 per cent to 28 per cent.

This is a misguided proposal. The overall corporate tax rate in the United States (including an average of state corporate taxes) will rise to more than 32 per cent, the highest rate among developed countries. And that does not include the effect of dividend taxes, which are a second layer of tax imposed on the same income when it is distributed to shareholders (and Biden wants to increase that tax rate as well).

Again, this is not a good recipe for jobs and competitiveness.

But there’s another provision of Biden’s Made in America Tax Plan that might be even more troubling. The White House wants to create a global tax cartel, to get all governments to set minimum tax rates. The White House says countries should “End the Race to the Bottom” because the “time has come to level the playing field and no longer allow countries to gain a competitive edge by slashing corporate tax rates.”

Translated into plain English, this is an “OPEC for politicians.” They all agree to keep tax rates high so businesses and entrepreneurs will no longer be able to shift jobs and investment to jurisdictions with better tax policy. And once a minimum tax is determined, there will be a big incentive to keep raising the rate. That will be good for governments and bad for taxpayers.

To grasp the radical nature of this proposal, imagine what it would mean for consumers if all grocery stores in a town got together and decided to “end the race to the bottom” on the price of eggs, bread and milk. There would be a furious reaction, and with good reason. Monopolies and oligopolies not only disadvantage consumers, they reduce economic vitality and dynamism.

The good news is that monopolistic cartels are extremely hard to create and maintain in the private sector. Simply stated, existing supermarkets would have an incentive increase profits by lowering prices, and new grocery stores would have an incentive to enter the market and attract consumers with competitive pricing. The attempted cartel would collapse.

But what if the cartel is being created by some of the world’s biggest and most powerful governments (many anti-tax competition initiatives are pushed through the OECD, a Paris-based international bureaucracy primarily representing the interests of governments in North America, Western Europe and the Pacific Rim)? And what if those governments then bully low-tax jurisdictions with threats of financial protectionism if they do not agree to join the cartel?

Those are disturbing questions to contemplate. If the Biden administration uses the power of the U.S. government, it’s possible that jurisdictions that have prospered with pro-growth tax policy—places such as Ireland, Hong Kong, Bermuda and Switzerland—will feel compelled to surrender their fiscal sovereignty.

The obvious impetus for Biden’s proposed tax cartel is that politicians want to halt—and then reverse—the tax competition-driven pressure for lower tax rates. The fear of losing jobs and investment is easily the dominant reason why average corporate tax rates in the developed world have dropped from nearly 50 per cent to less than 25 per cent over the past four decades. The Biden administration wants to undo this progress, and it’s joined by many other governments in supporting a tax cartel.

For what it’s worth, some academics (mostly tax law professors) embrace this campaign and actually have a theory (known as “capital export neutrality”) that purports to show that harmonized tax rates will be good for the economy. They start with the observation that different tax rates give entrepreneurs, investors and businessowners the opportunity to allocate resources on the basis of fiscal considerations, noting that this could lead to inefficient choices when compared to a hypothetical world without taxes or where all tax rates are the same.

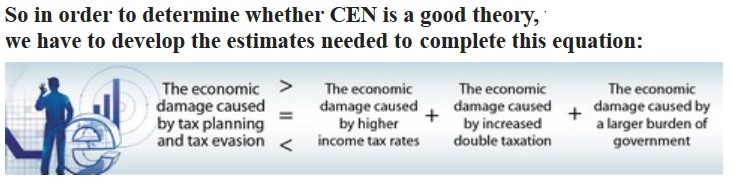

What they conveniently overlook, however, is that the absence of tax competition means more punitive tax policy (as economists would say, tax rates are not exogenous), presumably imposed to give politicians leeway to increase the burden of government spending. And those policies will impose significant damage on economic performance. The below infographic provides a good summary of why tax harmonization (i.e. the policy supported by capital export neutrality) almost surely will weaken growth.

The bottom line is that the so-called “race to the bottom” has actually been a race to better tax policy in recent decades. Thanks to tax competition, not only have corporate tax rates declined, but so have tax rates on households. Various forms of double taxation also have been reduced, meaning lower tax rates on interest, dividends, and capital. And the curtailing of death taxes and wealth taxes.

This is why tax competition should be celebrated rather than persecuted.

Author:

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.