Ford government pursuing McGuinty-style deficit-reduction strategy

When running for office in 2018, Doug Ford ran largely on a promise to fundamentally change Ontario’s approach to fiscal policy—specifically, that his government would reduce spending, balance the budget and reduce Ontario’s debt burden.

And yet, the evidence suggests that when it comes to spending and deficits, Ford government fiscal policy has been characterized more by continuity than by change.

The recent Ontario budget provides an especially useful case in point. Just like Dalton McGuinty’s government in the early 2010s, the Ford government today faces a large budget deficit and the province’s finances are not sustainable.

Despite the differences in rhetoric, the Ford government has chosen a deficit-reduction strategy that’s almost identical to the McGuinty government’s approach. Rather than reduce spending to eliminate the deficit quickly, the government plans to hold the rate of nominal spending growth low while hoping for revenue to catch up and eliminate the deficit over time.

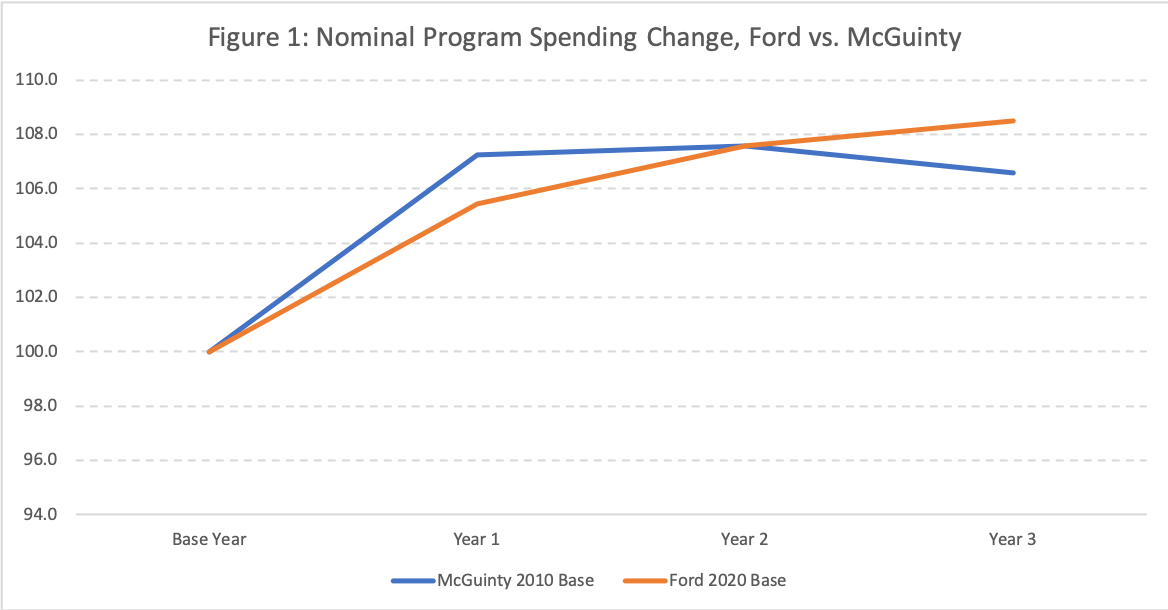

A close look at the Ford government’s recent budget illustrates the extent of policy continuity from its predecessors. Over the next three years, the Ford government forecasts it will increase nominal program spending (all spending other than debt interest) in aggregate by 8.5 per cent. By comparison, when Ontario was recovering from the 2008/09 recession, the McGuinty government held nominal spending growth to 6.6 per cent over a three-year period.

The chart below compares government program spending under Premier McGuinty in the early 2010s to the Ford government’s latest fiscal plan.

It’s important to note that the Ford government’s commitment to holding nominal spending growth to 8.5 per cent over three years is only a projection, and that governments frequently spend more than they plan. However, even if the Ford government meets its spending targets, its approach to deficit-reduction will still exercise less spending restraint than the McGuinty government did during the early 2010s when it was attempting to gradually reduce a large budget deficit.

Of course, COVID-19 is largely responsible for the size of this year’s deficit. However, that’s not the reason for the spending growth described above. These numbers, which are from the 2021 budget, exclude onetime emergency COVID spending, so we can compare fiscal plans over time.

Since the Ford government is embracing the same slow and gradual approach to deficit-reduction as its predecessors, it should come as no surprise that the province once again expects to see a rapid increase in government debt. According to Ford government forecasts, Ontario’s provincial government debt will climb from $440 billion this year to $502 billion in 2023/24.

Elections sometimes bring sharp changes in policy direction. In Ontario, when it comes to fiscal policy, this has not been the case. Instead, policy continuity has prevailed. Like its immediate predecessors, the Ford government has adopted a slow approach to deficit-reduction by mildly slowing the rate of spending growth to allow for revenues to gradually catch up. The result will be another run-up in debt comparable to what Ontario experienced during the 2010s under premiers Dalton McGuinty and Kathleen Wynne.

Author:

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.