Despite Alberta pleas, Trudeau government maintains ‘stabilization’ status quo

Despite being 700-plus pages in length, the new federal budget makes little mention of a certain hot topic—fiscal stabilization. Alberta Finance Minister Travis Toews expressed his disappointment, specifically that Ottawa is not retroactively removing an arbitrary cap that limits the emergency support provinces receive. Considering it’s a billion-dollar difference to Alberta, it’s worth understanding the program and its limitations a bit better.

The federal Fiscal Stabilization Program (FSP) is meant to act as a type of insurance program to help provinces that have seen a severe downturn in revenue. A province is eligible for payments from the federal government if its total revenues decline by more than five per cent and either resource revenue declines by more than 50 per cent, or non-resource revenue declines by more than five per cent.

The basic premise is rooted in risk pooling; if one province is hit hard by a recession or other fiscal shock, some of the pain is spread out across the rest of the country. Of course, in the recent COVID-related recession, the pain was widespread. Nevertheless, Alberta suffered one of the nastiest fiscal shocks of any province due largely to a sharp downturn in natural resource royalties. This is the second such shock in recent years, as Alberta also saw a sharp revenue downturn following the oil price crash in 2015/16.

So, to what extent has the FSP fulfilled its function of providing insurance to help Alberta’s government cope with these revenue declines? The answer is, not much.

In 2015/16, for example, Alberta received payments from the FSP—but only $249 million. For context, this was enough to offset just 3.5 per cent of Alberta’s year-over-year revenue loss.

Why did Alberta receive so little money?

It wasn’t the result of intentional FSP design, but rather of sheer policy neglect over decades. Specifically, payments had been capped by legislation in 1987 at $60 per person, an amount shaped by the decline in natural resource revenues from the forestry industry in British Columbia at the time.

The FSP cap wasn’t even indexed to inflation, and subsequently, the real value of the cap had been cut in half since it was introduced. Thanks to an arbitrary per-capita limit on payments and the effects of inflation on that cap over time, the program had withered to the point of near uselessness by the time Alberta became eligible in 2015/16.

In 2020/21, Alberta was hit by an even worse revenue shock and once again became eligible for payments. The Kenney government objected to the per-person cap, the removal of which would result in much larger payments. In fact, the Kenney government pushed for the change to be retroactive to past years.

Last year, the Trudeau government announced plans to reform the FSP to allow for larger payments, but the reforms did not go nearly as far as Alberta’s government wanted. Specifically, Ottawa increased the cap to $170 per person (2019/20 and 2020/21). This number is still based on the original cap created in the late 1980s ($60 per person), but indexed to economic growth since then. It will continue to grow in line with the rate of economic growth per person.

Although the original cap was for the most part arbitrary and so too is the new one, the reform at least reversed the gradual erosion its real value. That means more money for the provinces, including Alberta. But how much more?

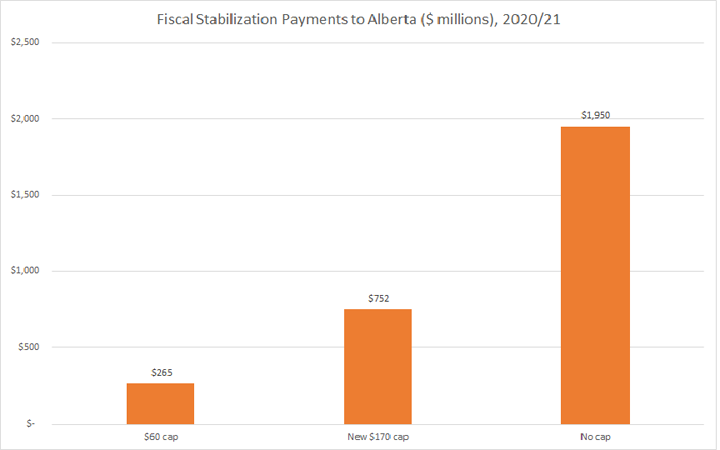

In 2020/21, Alberta’s revenue dropped by an estimated $3.9 billion. Under the old $60 cap, the province would receive approximately $265 million in support, which would cover 6.8 per cent of year-over-year revenue loss. Instead, it will receive nearly three times that amount, at approximately $752 million, or 19.1 per cent of the revenue loss.

Consider if the federal government went further and eliminated the cap entirely, as the Alberta government (backed by the other nine provinces) demands.

Setting aside the question of retroactivity, we estimate that an uncapped FSP formula would produce approximately $2.0 billion in stabilization payments for Alberta for 2020/21, or 49.6 per cent of the province’s revenue decline in 2020/21. That’s about three times what the province will actually receive, or a difference of $1.2 billion. If the demand for retroactive payments were met, it would produce another onetime payment of approximately $5 billion.

To be clear, larger payments won’t necessarily improve the FSP program. In fact, if a province knows it will be bailed out by Ottawa, it may be more inclined to spend freely during good times and rely on the government to cover its shortfall when it occurs, which can create incentives for bad budgeting.

So there are reasonable arguments for and against a more robust FSP. But there’s no good argument for payments to be primarily determined by an arbitrary cap. Indexing the cap since then to economic growth doesn’t change the arbitrary nature of the rule. The federal government should, perhaps in consultation with the provinces, decide how to handle the provision based on clearly articulated principles and objectives. In addition to making the program rational, this would help reduce the likelihood of future conflict and ad hoc changes to the program such as we saw in 2020/21.

Whatever the best course of action, this federal budget contained no new changes on fiscal stabilization. Despite getting little attention in the budget, that’s big news for Albertans.

Authors:

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.