CBC’s misleading tax ‘analysis’—a disservice to Canadians and the inequality debate

A CBC News analysis making the rounds online shows that an increasing number of upper-income Canadians are getting away without paying any income tax. The analysis is highly misleading and fuels misplaced concerns about the distribution of income taxes in Canada.

The main claim is that “between 2011 and 2014, a growing number of Canadians earning a six-figure income or more didn't pay a cent in income tax.” On the surface, this sounds problematic. But don’t ring the alarm bells just yet.

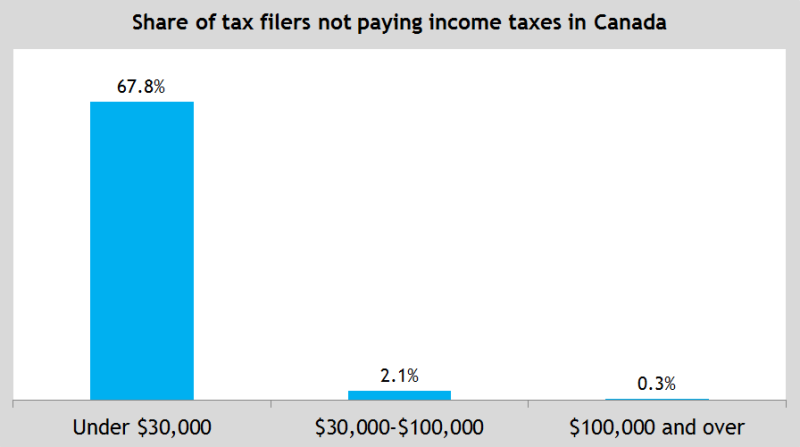

For perspective, the actual number of tax-filers with incomes $100,000 and over who don’t pay income tax rose from 4,050 in 2011 to 6,110 in 2014. So what we’re talking about is 0.02 per cent of all tax-filers or 0.26 per cent of tax-filers with incomes $100,000 and over. The notion that there’s a large number of well-off Canadians not paying income tax simply doesn’t fit the facts.

More importantly, what’s happening with this tiny group of tax-filers in no way reflects the broader reality of upper-earners in Canada. In reality, upper-earners in Canada continue to shoulder a disproportionate share of the country’s income taxes.

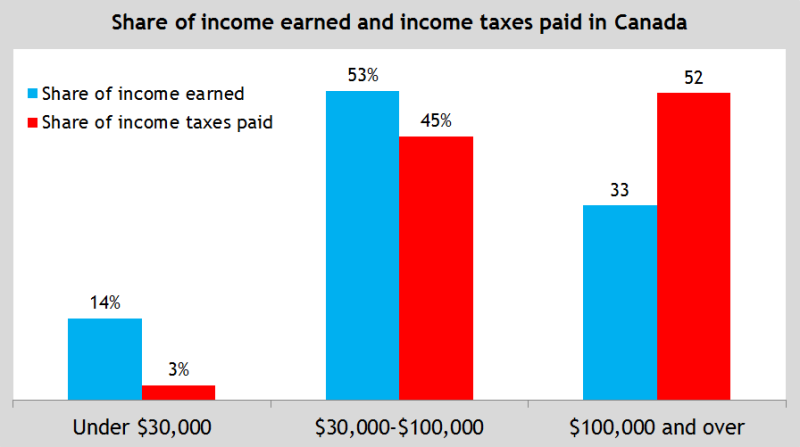

If we just look at personal income taxes, in 2014 tax-filers with incomes $100,000 or over earned 33 per cent of Canada’s total income yet paid 52 per cent of federal and provincial income taxes (see chart below). That means the country’s high-skilled educated workers—including entrepreneurs, business professionals, engineers, doctors and lawyers—carry a disproportionate share of the country’s personal income tax burden.

Meanwhile, lower-income earners pay proportionately less. Specifically, tax-filers with incomes less than $30,000—roughly the bottom half of earners in Canada—earn 14 per cent of all income yet pay only 3 per cent of income taxes.

In fact, more than two-thirds (67.8 per cent) of these tax-filers do not pay any personal income tax after accounting for the various deductions and tax credits (see chart below). In other words, it’s much more common for lower-income earners to not pay income tax compared to upper-income earners.

Simply put, the imbalance between lower- and higher-income groups, in terms of the percentage of income earned and total taxes paid, contradicts the view that upper-income earners don’t pay a significant share of income taxes.

Authors:

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.