A brief fiscal history of Alberta—marked by spending spikes

As the Kenney government prepares to release its 2021-22 budget later this week, it’s grappling with the largest nominal budget deficit in Alberta history—more than $20 billion—due largely to the pandemic. However, Alberta’s previous 2019-2020 deficit of nearly $12 billion was already its fifth consecutive deficit. And its erstwhile golden status as the only province without a net provincial government debt ended in fiscal year 2016-17. By 2019-20, the net debt stood at $40.1 billion and will stand at more than $60 billion for 2020-21.

Some observers want Alberta to introduce a new sales tax to help deal with current shortfalls. However, Premier Kenney says that there will be no new taxes. (Incidentally, even a new 5 per cent HST would still leave a rather large gap in the current deficit.) Indeed, Alberta’s fiscal problems are longstanding and rooted in resource revenue volatility and program spending that has grown to become the most generous in Canada. Since 2005, nominal per-capita program spending in Alberta has averaged about 14 per cent above the Canadian average.

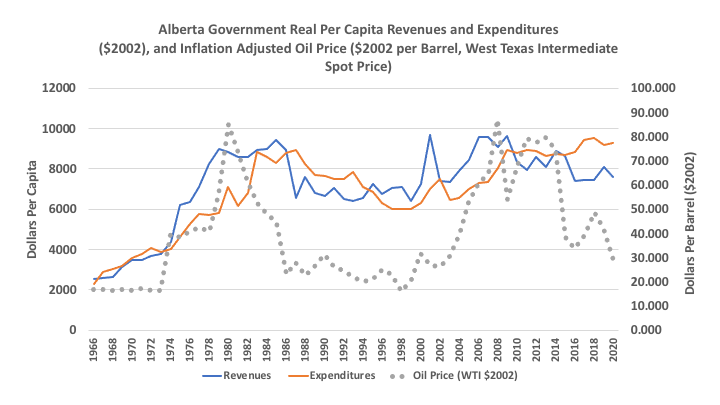

The fiscal situation in Alberta over the very long haul can be summarized in the chart below. The revenue, expenditure and deficit data for these figures are for the period 1966 to 2020 and come from Finances of the Nation. The deflator used is the CPI from Statistics Canada ($2002) (along with the population data) and the price of oil is the annual monthly average for West Texas Intermediate (WTI) obtained from FRED.

The chart plots real per-capita Alberta government revenues and expenditures since 1966 along with the inflation adjusted price of WTI oil. There have been two broad upward cycles of per-capita revenue and expenditure growth in Alberta, which coincide with upturns in the price of oil. From 1970 to 1981, the inflation-adjusted price of a barrel of oil rose almost 350 per cent while Alberta’s economy and public finances boomed with real per-capita revenues and spending growing 148 per cent and 73 per cent respectively. The result was the natural resource share of Alberta government revenues rising from slightly more than 20 per cent to more than 50 per cent, and an era that saw 13 consecutive budget surpluses from 1974 to 1986.

The subsequent fall in oil prices and the end of the first oil boom saw an era of falling per-capita government spending and revenues and eight consecutive budget deficits from 1987 to 1994. At this point, the imbalance was addressed by expenditure reductions, and despite low resource prices, surpluses began to emerge. From 1995 to 2009, Alberta ran surpluses in 14 out of 15 years.

However, the rise in oil prices that began in 2000 was accompanied by a rebound in spending. And between 2000 and 2009, real per-capita spending in Alberta grew 40 per cent. And yet, since the peak in the latest cycle of oil prices in 2012, per-capita spending has not declined while revenues have fallen. In fact, from 2009 to 2020, real per-capita spending grew 4 per cent while revenues fell 21 per cent.

Clearly, Alberta’s fiscal woes are rooted in the boom-bust nature of an economy dependent on natural resource revenues. That’s not a problem per se, but the volatility of a revenue base that since the 1970s has accounted for as much as 50 per cent—and as little as 8 per cent—of provincial government revenue is not the most stable base for steadily rising spending.

Even more disappointing is that during times of plenty, Alberta did not make more of an effort to invest its resource revenue in its Heritage Fund as a buffer, instead preferring to use upturns in resource revenues to fuel spending. Indeed, it’s estimated that had Alberta consistently invested even 25 per cent of its non-renewable resource revenues after 1982, the province would have contributed more than $40 billion to the fund, and after investment growth ultimately, be worth many times more than the current $17 billion.

So, what’s to be done?

The general solution to an imbalance in spending and revenues is either raise revenues, cut spending or a combination of both. It’s difficult to see how Alberta’s fiscal situation can be resolved without some reductions to its generous government program spending. As for increases in revenues, a new sales tax would indeed bring some stability to the province’s volatile revenue mix. But it must be combined with a general compositional reform of taxation that reduces reliance on income taxes. Moreover, the additional revenues will come to naught if any recovery of resource revenues is simply used to ramp up spending again.

In Alberta, embarking on enhanced spending once the economy recovers simply makes for a never-ending fiscal Groundhog Day.

Author:

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.