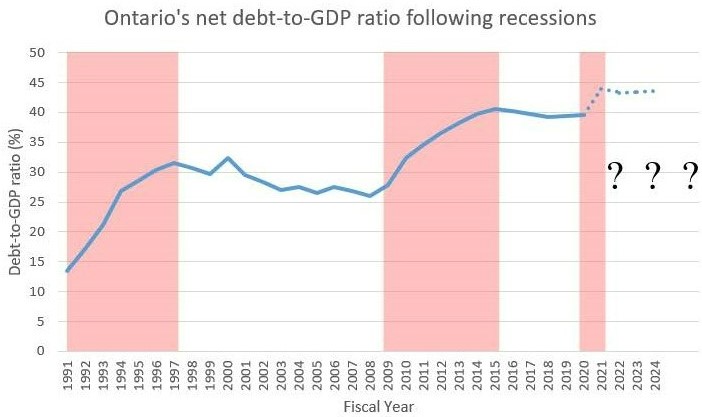

Will Ontario avoid another post-recession era of debt growth?

When it comes to government finances, Ontario is at a crucial juncture. In the recent past, Ontario’s recessions have been followed by extended periods of debt growth. Given that the province’s finances are already unsustainable, the big question is whether history will repeat itself.

The story of Ontario’s debt accumulation pre-pandemic is a tale of two recessions. In 1991, Ontario’s debt-to-GDP ratio stood at 13.4 per cent. In the following years, the province endured a severe recession. Provincial debt climbed quickly both during the recession and in the years that immediately followed.

The 2008 recession marked another era of rapid debt-to-GDP growth during the recession and over the following half decade. This indicator proved a one-way ratchet, and held steady in the following years rather than dropping back down to pre-recession levels.

It remains to be seen whether Ontario will experience another big run-up in debt following the COVID recession. The Ford government is optimistic, forecasting no further debt-to-GDP growth in the years ahead.

Given Ontario’s unsustainable debt load, budget watchers will be paying close attention to whether these optimistic forecasts come to pass, or whether Ontario will once again see its debt burden climb like in the 1990s and 2010s.

Authors:

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.