More money from Ottawa the wrong solution to Ontario’s fiscal challenges

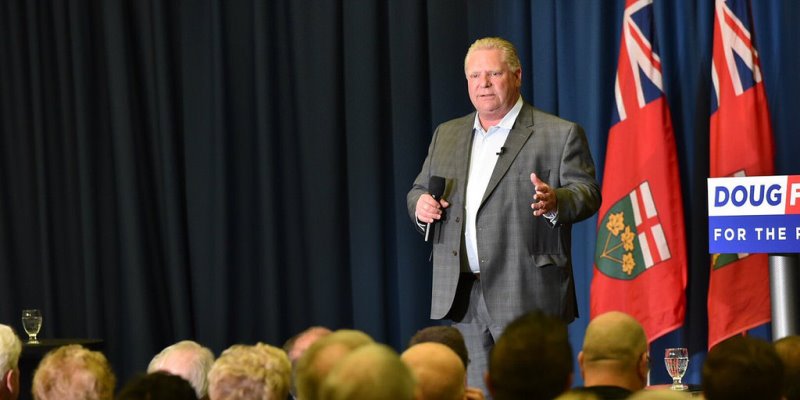

Ontario premier Doug Ford used a recent meeting of premiers to encourage his counterparts to join him in pressing the Trudeau government for an increase in cash transfers to help the provinces cope with rising health-care costs.

And Ford is right to be worried about upward pressure on health expenditures from an aging population.

But having Ottawa write bigger cheques to the provinces is not the solution. Instead, the answer counterintuitively lies in the federal government writing smaller cheques to the provinces—while lowering federal tax rates, allowing the provinces to raise their own money to pay for provincial services.

To understand why this approach can work, it’s helpful to look at the current arrangements. As things stand, the federal government raises more money in taxes than it needs to deliver federal services. Meanwhile, the provinces don’t raise enough. To rectify this imbalance, the feds write big cheques to the provinces to help them cover the cost of big-ticket items such as health care and social programs.

This is a disaster, from the standpoint of democratic accountability.

When things go wrong in provincial health care, it’s often almost impossible for the average Canadian to figure out who to blame. The provincial governments often blame the feds for the problems, saying that don’t get enough money from Ottawa. In turn, the federal government generally denies the charge.

How can we evaluate these competing claims? The Canada Health Transfer (from the federal government to the provinces) will eclipse $40 billion this year. It’s an unfathomable amount of money. As a result, the fights between the provinces and the federal government, about whether the transfers are “enough,” are inscrutable and just about nobody knows who to blame when things go wrong.

So how should the problem be fixed? In short, Ottawa should greatly reduce the amount it sends the provinces for areas of provincial responsibility while reducing federal taxes at the same time. At that point, it would be up to the provinces to decide how much they want to increase their own taxes to pay for services they provide.

Under this system, when the same level of government that delivers services must raise the money to pay for them, the confusing blame game disappears (or at least greatly dissipates) and citizens can decide whether they get value for the provincial taxes they pay.

To be fair, there’s nothing simple about implementing this approach. Lower-income provinces will correctly worry about raising their tax rates much more than higher-income provinces to replace lost federal transfer revenue.

There are, however, potential solutions to this problem, which involve compensating lower-income provinces. None of these potential solutions are perfect, but several are better than the current approach of the federal government sending so much money to all of the provinces and then bickering endlessly about how much is enough.

Premier Ford is right to worry about rising health-care costs due to an aging population. But he’s got the wrong solution. Instead of more money for the provinces from Ottawa, the best answer may actually be less—combined with federal tax cuts to create room for the provinces to raise their own money to pay for the services they deliver.

Author:

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.