Low-income individuals and families facing high METRs would benefit from lower claw-back rates.

marginal tax rate

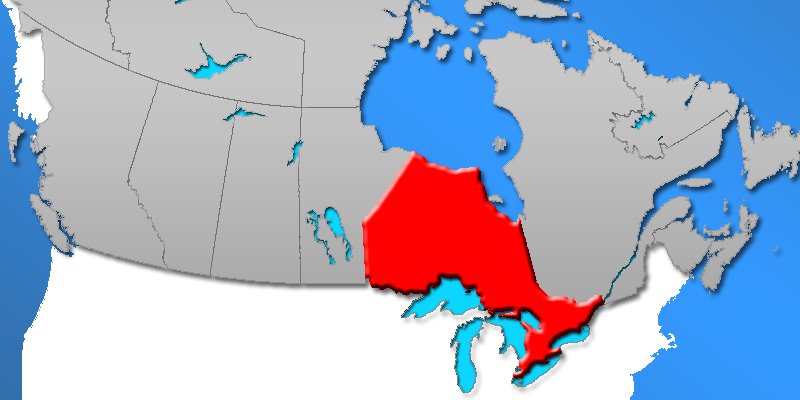

Ontario increased its top rate to 20.53 per cent.

Ontarians are on the hook for approximately 40 per cent of the federal government’s net debt.

In Ontario, the combined provincial/federal top marginal income tax rate is 53.5 per cent.

The PC platform would not reduce the sky-high top marginal rate facing highly-skilled workers.

In this year’s budget, the Wynne government forecasts a nearly 5 per cent increase in program spending.

The federal Liberals plan to increase the top federal personal income tax rate.

The new Trudeau government plans to raise personal income taxes on the top one per cent of Canadian income-earners in order to fund a personal income tax decrease on the middle class.

The Liberal campaign platform has some laudable goals. However, one of the worrying policy initiatives, and one that is hopefully de-prioritized, is the raising of the top marginal federal tax rate on personal income from 29 to 33 per cent.