Instead of pumping the brakes, Ontario government accelerates spending and debt accumulation

Since taking office, the Ford government has repeatedly increased spending, racked up significant debt, and refused to meaningfully reduce taxes. This year’s provincial budget promises more of the same in what can only be characterized as a “stay the course” fiscal plan.

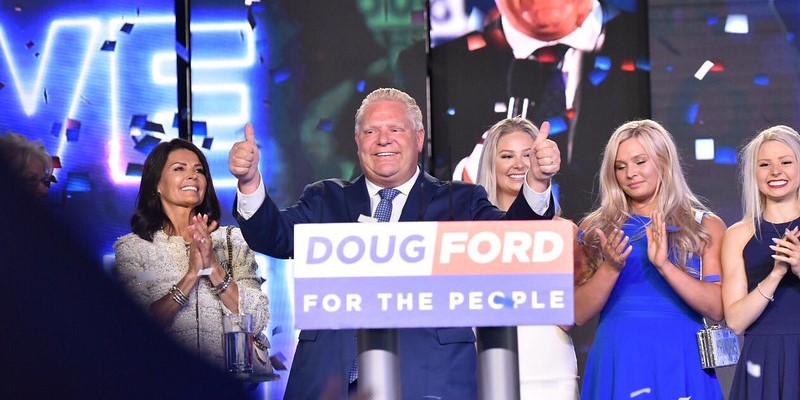

This approach to governance is the opposite of what the Ford government promised Ontarians when it first took office. On the campaign trail in 2018, then-candidate Doug Ford disparaged his predecessor’s “reckless spending” and continued deficits. As an alternative, he campaigned as the “only party that’s fiscally responsible” and promised to reduce taxes. However, this rhetoric has not matched Premier Ford’s policies.

By the end of this fiscal year, the Ford government will have run deficits in five of the six years it’s been in office and accumulated roughly $91.7 billion in new debt. The government’s reliance on borrowed money stems from an unwillingness to restrain growth in program spending—the same unwillingness demonstrated by previous governments.

Between 2017 and 2023, inflation-adjusted per-person program spending (spending excluding debt costs) has grown from $12,492 to $12,783. And, as one analysis found, had the Ford government simply maintained the Wynne government’s level of per-person spending, it would have accumulated $27.8 billion less debt than currently expected.

Budget 2024 repeats the same mistakes and the pages are covered in red ink. In the 2024/25 fiscal year, Ontario will post a projected $9.8 billion deficit. The plan forecasts an additional deficit of $4.6 billion in 2025/26 before returning to budget balance in 2026/27. This is markedly worse than the forecast presented by the government last spring, which projected surpluses in both 2024/25 and 2025/26.

The combination of budget deficits and substantial spending on capital investments such as schools, hospitals and highways are expected to increase provincial debt by $59.7 billion over the next three years. Current and future generations of Ontarians will bear the weight of this additional debt. In the upcoming fiscal year alone, debt interest payments will cost each Ontarian $868. This means more taxpayer dollars will be spent on debt interest instead of other priorities including post-secondary education and training.

High levels of government spending are once again driving this surge in debt. The government will increase program spending (total spending excluding interest costs) by $4.2 billion in 2024/25 and $3.5 billion in 2025/26 compared to last spring’s budget forecast. Instead of pumping the brakes, the government is choosing to press its foot forcefully on the gas pedal.

To put the government’s failure to restrain spending in context, consider where provincial finances could be today had the Ford government simply maintained its spending plan from two years ago in Budget 2022. By sticking to its original program spending estimates, the government would be on track to spend $12.5 billion less in 2024/25 than what it targets in this budget. In doing so, the government could’ve recorded a $3.7 billion surplus (excluding the $1.0 billion reserve) this year.

While Finance Minister Bethlenfalvy recently stated “We’re going to continue to focus on making life a bit more affordable for people,” the budget ignored meaningful ways to reduce the single largest expense for Ontarian families—taxes. The average Ontarian family (consisting of two or more people) paid 45.9 per cent of its income in total taxes in 2023. Ontarians are still waiting for the personal income tax cut that Premier Ford promised six years ago.

This budget undoubtedly comes as a disappointment to anyone hoping for a fresh approach to provincial finances in Ontario. But it comes as no surprise. The Ford government, like its predecessors, prefers to simply stay the course and hope for the best.