Canada’s Rising Personal Tax Rates and Falling Tax Competitiveness (2019)

In December 2015, Canada’s new Liberal government introduced changes to Canada’s personal income tax system. Among the changes for the 2016 tax year, the federal government added a new income tax bracket, raising the top tax rate from 29 to 33 percent on incomes over $200,000. This increase in the federal tax rate is layered on top of numerous recent provincial increases. Starting with Nova Scotia in 2010, through 2018 at least one Canadian government has increased the top personal income tax rate in every year except 2011. Over this period, seven out of 10 governments increased tax rates on upper-income earners. As a result, the combined federal and provincial top personal income tax rate has increased in every province since 2009.

The largest tax hike has been in Alberta, where the combined top rate increased by 9 percentage points (or 23.1 percent), in part because the new rates were added to a relatively low initial rate. In Ontario, the combined top rate increased by 7.1 percentage points (or 15.3 percent); in Quebec it increased by 5.1 percentage points (or 10.6 percent).

These increases have important consequences for Canada’s economy. In particular, high and increasing marginal tax rates—that is, the tax rate on the next dollar earned—discourage people from engaging in productive economic activity, ultimately hindering economic growth and prosperity. This occurs because marginal tax rates reduce the reward of earning more income and, in the case of personal income taxes, more labour income. There is general agreement in the economic literature on this point; the debate is about the magnitude of the effect.

The federal and provincial increases to Canada’s marginal income tax rates from 2009 to 2018 have put the country at a greater competitive disadvantage for attracting and retaining skilled labour and, less directly, investment and entrepreneurs. Even before the changes, the country’s combined federal and provincial top marginal tax rates compared unfavourably to those in the United States and other industrialized countries.

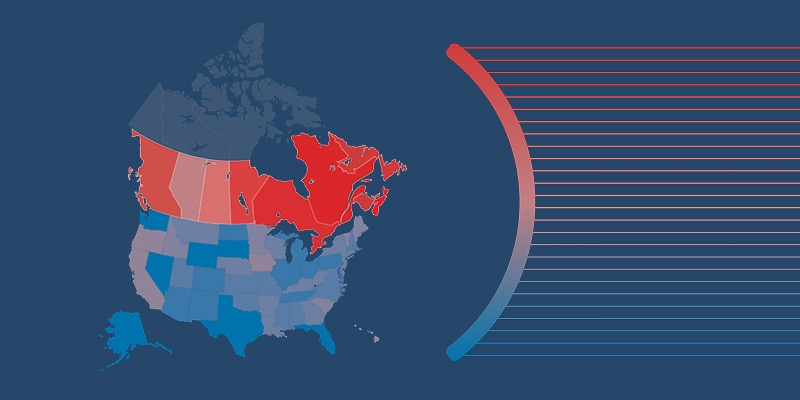

Out of 61 Canadian and US jurisdictions (including the provinces, states, and Washington, DC), Nova Scotia currently has the highest combined top statutory marginal rate (54.00 percent), followed by Ontario (53.53 percent), and Quebec (53.31 percent). Nine Canadian provinces occupy the list of 10 jurisdictions with the highest top combined marginal income tax rates and all provinces are in the top 12. There are a total of 49 US jurisdictions with combined top tax rates that are lower than all Canadian provinces.

The fact that Canada’s top tax rates are often applied to lower levels of income than is the case in other countries further erodes our tax competitiveness. To adjust for differences in income thresholds, we compare the combined statutory marginal tax rates at various income levels in Canadian dollars for each Canadian and US jurisdiction. At an income of CA$300,000, the highest threshold (with the slight exception of Alberta) in which a Canadian combined top rate is applied, Canadians in every province face a higher marginal income tax rate than Americans in any US state. Results are similar at an income of CA$150,000 and Canada’s marginal tax rates are also uncompetitive at incomes of CA$75,000 and CA$50,000.

Taken together, Canada’s personal income tax rates are decidedly uncompetitive compared to those in the United States. And, Canada also competes with other industrialized countries for highly skilled workers and investment. To measure the competitiveness of Canada’s top tax rates, the study compares the combined top statutory marginal income tax rates with rates in 34 industrialized countries. In 2017 (latest year of available international data) Canada had the 7th highest combined top tax rate out of 34 countries. The federal change to the top rate in 2016 has markedly worsened Canada’s competitive position. For instance, Canada had the 13th highest combined tax rate in 2014, before the changes in the federal top rate.

Canadian governments have put the country in this uncompetitive position in part to raise more revenue as they grapple with persistent deficits and mounting debt. However, the tax increases are unlikely to raise as much revenue as governments expect since taxpayers—particularly upper-income earners—tend to change their behaviour in response to higher tax rates in ways that reduce the amount of tax they might pay. Federal and provincial governments would do well to consider reversing the trend towards higher marginal tax rates on upper-income earners, and lower personal income tax rates.